The mortgage process automation platform for efficient teams

Saaf automates extraction and empowers teams to make better, faster decisions using source of truth data from original loan docs.

AI-powered automation for your mortgage operations

Data extraction, Verification, Indexing

Extract up to 25k data points per loan package and highlight inconsistencies

Due

Diligence

Automated QC and re-underwriting workflows, accelerate diligence completion

Underwriting

Add custom overlays in addition to Conventional, FHA, VA, NonQM underwriting automation

Compliance

Reporting

Detailed reporting on loan-level data; meet regulatory and risk goals

Post Trade

Seamless loan package and post trade settlement document delivery

Loan

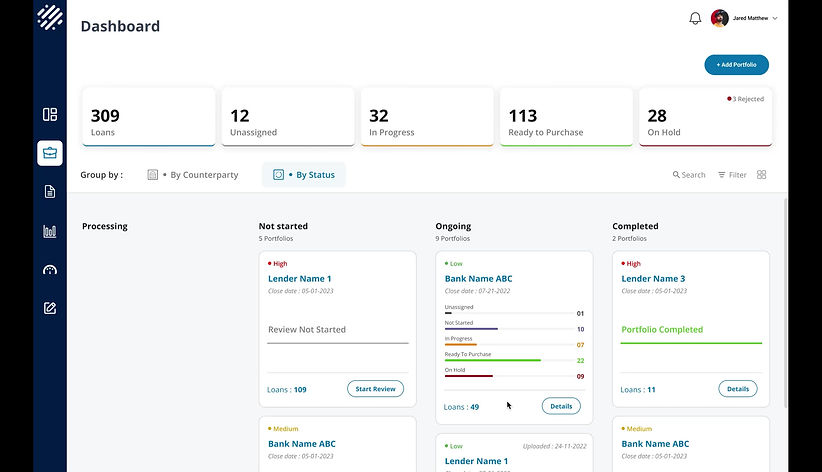

Transaction

Collaborate with counterparties to expedite and clear purchases

Deliver better results for your business

66%

Cost reduction compared to traditional diligence vendors and processes

80%

Time saved per loan package for your team

25K+

Data points per loan package increases reliability (indexing, cross verification, QC)

>5x

ROI based on current vendor and capital cost

The Saaf leverages decades of mortgage diligence, operations and technology expertise.

200K+

Real mortgage loans used to train our AI engine

500+

Base document types and 12K+ variations processed, allowing full loan package processing

100K+

Rules developed over 20+ years experience

20+

Years of mortgage diligence and underwriting expertise

Drive your business forward with

Saaf’s source of truth data.

Empower your teams to make data-driven decisions with confidence, using our secure and compliant platform.